With inflation expectations rising, we are seeing renewed interest in stable real (and virtual) assets. Unfortunately, they are anything but.

Why are inflation expectations rising?

Central banks have been pumping money in the world’s largest economies ever since the financial crisis of 2008-2009. This is no news at this point, but they doubled down on the efforts to supports their virus stricken economies. Most importantly, as Democrats took control of the US presidency and both houses of Congress, expectations are that the new administration will push even more stimulus, including direct support (e.g. stimulus checks in the mail) and large spending programs such as infrastructure and energy transition.

The Case for Stable Real Assets

Cash has no intrinsic value, so if there is a rapid increase in inflation, the money in your bank can become worthless overnight. If you buy a house, however, it will still have value tomorrow as it provides a service: housing. So does gold, it can be turned into jewelry, which has value. And so does… well no, bitcoin doesn’t really have any value (but some people like to think it does, which I guess is worth something in and of itself). Once the inflation episode is over, people can then convert their real assets into cash and keep their same purchasing power. Presumably, if one house bought you ten cars before, it will still be worth that many cars today, even if the price of houses and cars has increased hundred-fold in the meantime.

The theory makes a lot of sense and stable assets were probably incredibly valuable in the economies of Hungary in 1945-1946 (4.19% x 1016 inflation), Zimbabwe in 2007-2008 (7.96% x 1010 inflation) and Venezuela in 2018 with its modest inflation of 65,000%.

Why stable assets don’t make sense now?

The problem is not that big

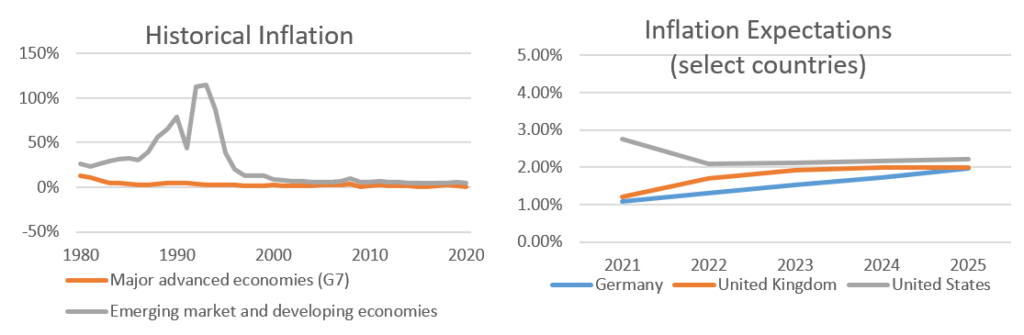

Hyperinflation is a huge problem, just not for modern developed democracies. Inflation has been incredibly stable in G7 economies with independent central banks. Central banks’ only job is to keep inflation low and they have been doing a pretty good job at it (see chart below). In addition, current inflation expectation about the future are fairly benign around and mostly below 2%, which not coincidentally is most central banks’ target. People and markets might be worried about inflation, but there is little reason to, based on historical data and current expectations.

In short, if you live in Venezuela and are afraid you will lose 90% of your wealth, it makes sense to start getting creative with asset allocation. Trying to safeguard against 1-2% unexpected inflation – you are just looking for trouble.

The solution is not that great

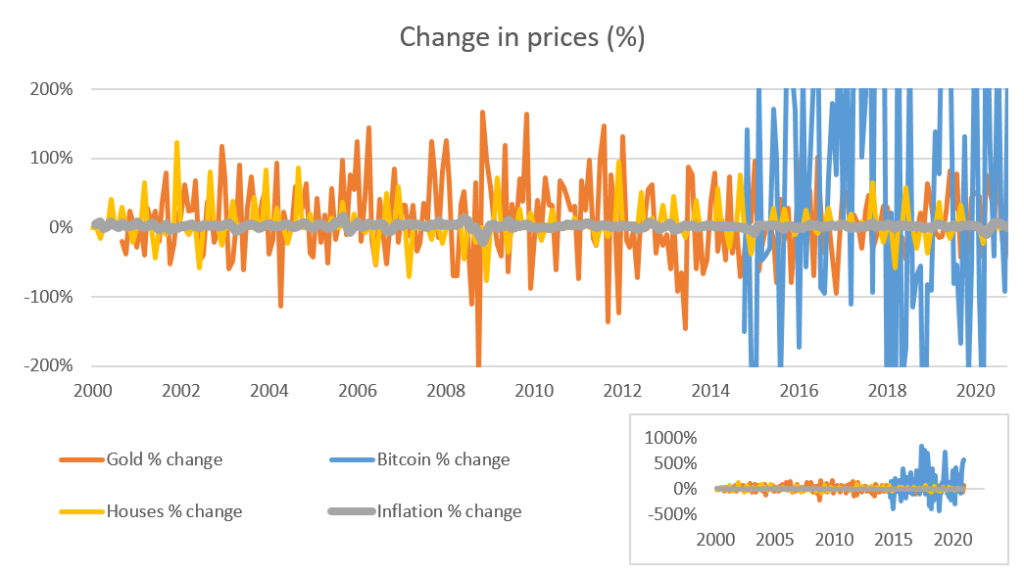

So how much comfort do the traditional real stable assets provide then? Not much. You can see in the chart below the change in the price of houses, gold, bitcoin, and inflation level in the US over the last 20 years. Inflation is by far the most stable assets of the four! Meaning, if you are trying to retain value you are much better off keeping your money in cash, which is only subject to inflation, instead of investing in all sorts of “real products” that are so volatile, you never know how much value you will be able to realize, once you sell.

(As you can see in the main graph Bitcoin is literary off the charts . For scale, see the smaller chart, which lacks some of the detail, but it makes obvious that Bitcoin volatility dwarfs any other asset on the chart.)

This is a classical case of the cure being worse than the disease. Inflation is a pain in the neck – no one likes to see hard-earned money evaporate. However, riding wild assets bubbles is no way to save either.

Note, I am not making a judgment on how good of an investment houses, gold, or Bitcoin is. I am saying they are very poor inflation hedges. If you are trying to park your money temporarily until inflation subsidies, these are suboptimal. As far as investment is concerned though, I do think Bitcoin is terrible (see article), gold is pointless, as its only investment value is an inflation hedge and it is a poor one, and houses could go either way depending on circumstances (see section on housing in this article).

So is there no way to protect your savings?

There are plenty of ways, which admittedly are less sexy than Bitcoin but also are not going to make you lose your hair, so that’s one trade-off worth considering.

Long term investors – stocks. If you already have your savings in the stock market – good news, there is nothing else you need to do. Stocks provide a natural hedge against inflation. If prices in stores rise, so will the price of products your portfolio companies sell. Of course, stocks themselves are a volatile asset class, so if you are looking to park your money for a year, it would not be my first choice. But if you are a long-term buy and hold investor, stocks are the easiest way to avoid inflation eating away your savings, while getting a healthy premium on top.

Short term investors – floating rate notes and loans. If you think you will need the money soon-ish but do not want to leave it in the bank at 0%, you can invest in floating-rate notes and loans. Their interest rate traditionally resets every 3 months, and it tracks inflation closely. They are not very high yielding products, especially these days, but should at least cover inflation and give you some interest on top.

Very risk-averse investor – Treasury Inflation Protected Securities (TIPS). These are essentially US government debt instruments, which are risk-free and they adjust for inflation. Given you bear effectively no risk (from default or inflation) these have extremely low yields but they do protect you from inflation, somewhat unsurprisingly given the name.

In emerging markets, where inflation plagues economies for years, people are unfortunately forced to think outside the box to preserve what little they have saved. In the West, however, between central banks and standard investment products, the risk can largely be mitigated. Investing in real (and virtual) assets to avoid a non-existing issue is an adventure most people can probably do without. The simple answer is usually the correct one – please say inside the box, if you can!

One thought on “(Un)stable Assets”

Comments are closed.