Let me save you a 5 minutes of reading and potentially some sizable investment losses – it is not.

A technology company

Telsa Inc. has recently reached the astronomical market valuation of $834 billion. Much of the argument in support of that number, if there is any, is that Telsa is not in fact a car company but a technology company.

To set the record straight, Tesla mostly sells vehicles with four wheels and a steering wheel. You don’t get much closer than that to a car company. Sure they have innovative technology – modern batteries, superchargers, computer-assisted driving, remote performance optimization, and most importantly, Netflix available on the dashboard. They also, somewhat disappointingly, sell cars. Virtually every company in the world uses innovative technology in their manufacturing processes, design, marketing, and final products, it does not mean they are all technology companies.

Even if it was a technology company (however you choose to define that), contrary to popular belief, tapping your heels three times and whispering “technology” into the wind, does not summon unlimited returns. Any company, tech or not, is worth the present value sum of all future free cash flow. Labeling a company as “technology” doesn’t make math disappear.

A leader

“But Tesla is so far ahead of everyone else”. True, they have high performing vehicles on the road and rapidly scaling mass production sites, while competitors are still spending heavily on R&D with little to show for. GM’s answer is not exactly screaming “sexy!”, although it apparently has pretty good uptake in China.

Hongguang Mini EV produced by a SAIC-GM-Wuling joint venture in China

It is also worth noting that Telsa did release its patents to the public so the technology is not even proprietary. Even if they had not, Ford was a market leader at one time, and so was Nokia, Yahoo, Toys “R” Us, Enron, and a lot of other companies, which were ahead of the competition until they weren’t. Unless you have a defensible long term competitive advantage (like a unique resource or patents… ops), it does not matter how innovative you are. Competitors will enter the industry, you will lose market share and margins will go down.

Growth story

For any company with sky-high valuations, optimists say, it will “grow into its value”. Meaning, yes, it is not worth that much, based on what it produces today, but it will in the future, as it grows. Fair enough, markets are forward-looking and in general pretty good at pricing what will happen in the future. Historical data is largely irrelevant.

Source: Yahoo Finance

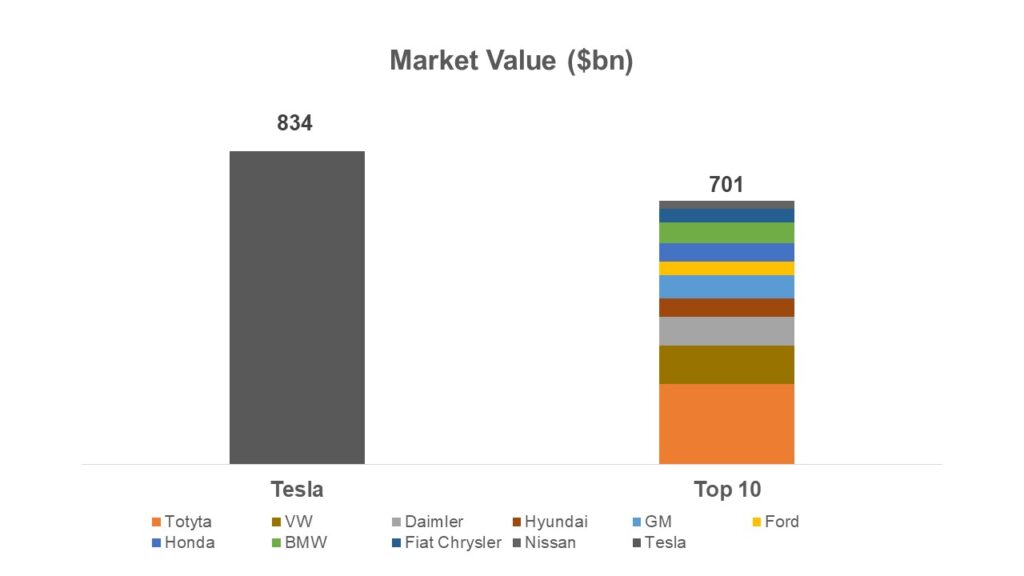

Currently, Telsa is 20% more valuable than the Top 10 Automakers combined. This is eye-popping in its own right but let’s see what assumptions are being made about Tesla’s future to warrant that.

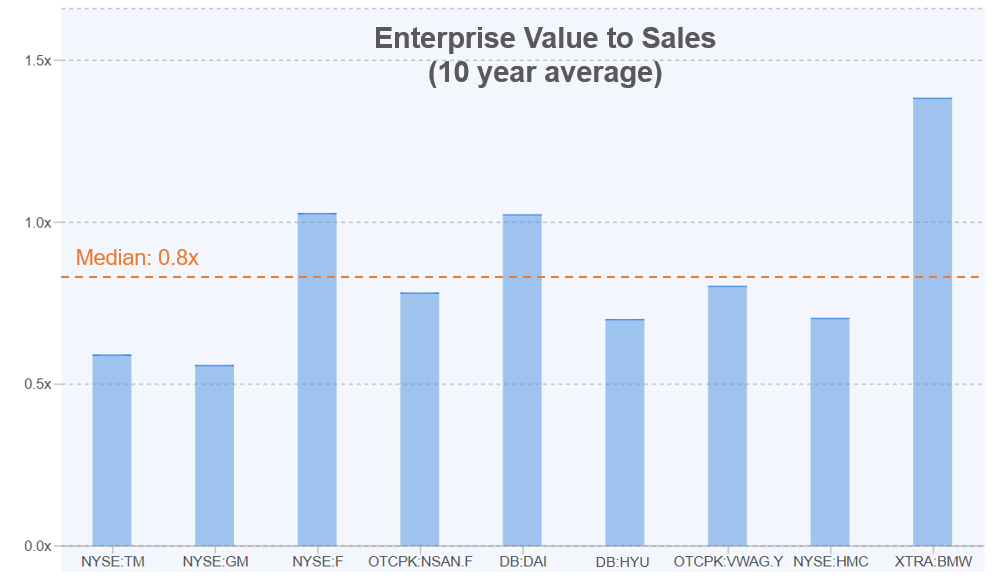

Source: Finbox.com

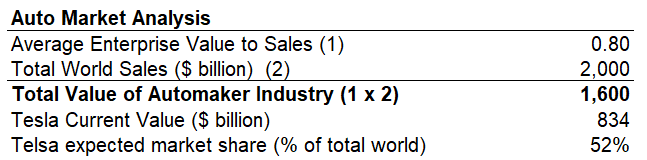

Source: oica.net, yahoo finance, finbox.com

There are a few take-aways from the charts above. We know that the value of any auto company is about 0.8x its annual revenue. Therefore, we can approximate that the value of the entire auto industry (regardless of who has what share) is c. $1,600 billion. At $834 billion Tesla is expected to represent 52% of the entire industry, in perpetuity. How realistic is that?

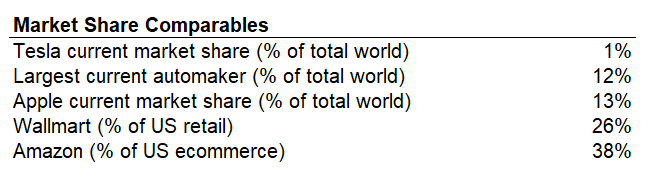

Source: emarketer,com, statista.com, oica.net, yahoo finance

Tesla currently has 1% of the world auto market. The largest carmaker in the world currently, Toyota, has 12%. For comparison, Apple, the highest-valued company in the world and an iconic brand has 13% of the global smartphone market. Walmart and Amazon, which are ubiquitous in their markets, only achieve 26% and 38%, respectively in their domestic market, let alone global. In short, getting to 50% global market share is virtually impossible, for any company, in any industry, tech or not. Holding on to 50% market share forever is just crazy talk.

Should I short Tesla then?

I wouldn’t! As unfortunately we have seen time and again, Tesla and all sorts of other hype-stocks, are almost impossible to short. Short sounds like the opposite of owning a stock long, but it is not.

Expensive – you pay to borrow the shares you sell short, and if the short is open for years, until people realize you were right all along, you will still pay the borrow cost for years. On top of that, you have to pay, to the stock lender, the dividends the company distributes in the meantime, out of your own pocket.

Margin calls – if you own a stock and it goes down to $0, it is unfortunate and you have lost your investment but that is the most you can ever lose. You even have some option value, if the stock miraculously rebounding after bankruptcy. With a short, the price can keep rising theoretically forever, prompting margin calls from your broker. Essentially you lose your entire investment and you need to put in more money to cover further losses. You might be absolutely right and the price could eventually go down, but unless you have unlimited money in the meantime, you might lose your shirt, waiting for the market to finally wake up to reality.

Unfortunately, there are some wrongs we just cannot right.

Ok, so I can’t short Tesla, but it is still a bad company and it will go bankrupt?

Hard to tell, most companies ultimately go bankrupt, but there is no reason Tesla will any time soon. All I am saying is that the market price is completely divorced from any reasonable best-case scenario about the company. My guess is both the company and the electric vehicles market will mature over the next 5-10 years and hit a plateau of growth and sales like any other market. In that more stable environment, people will reprice the shares down, realizing it cannot achieve, much less hold 50% market share in perpetuity. Until that time – the sky is the limit! But remember what happened to Icarus when he flew too close to the sun.