“It is said that despite its many glaring (and occasionally fatal) inaccuracies, the Hitchhiker’s Guide to the Galaxy itself has outsold the Encyclopedia Galactica because it is slightly cheaper, and because it has the words ‘DON’T PANIC’ in large, friendly letters on the cover.”

Douglas Adams, Hitchhikers’ Guide to the Galaxy

I can think of nothing that summarizes this article better than the quote above from Douglas Adams. It is free to read, it has some omissions for brevity (hopefully not fatal), and it says “Don’t Panic” in friendly letters. It also gives you almost everything will ever need to know about inflation.

Inflation basics

In 1970 Milton Freedman said, “Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output”. However, you may feel about Friedman’s politics, the man knew his economics – they don’t just give away Nobel prizes for no reason. Here is how his model works in a simple economy. Imagine all there is in our economy are 100 apples and $100 cash, regardless of how it is distributed between people in the economy. You cannot save apples for next year and you cannot save money for next year. Under this setup, the market will clear at $1. If we increased the money supply to $200, then every apple will cost $2, if we cut the money supply to $50, the cost would be $0.5. It is as simple as that. You might have heard the more colloquial expression: inflation is more money chasing fewer goods, which conveys the same sentiment.

Helicopter Ben

Fast forward 40 years to 2008, the U.S. is in financial meltdown, and urgent action is needed to save the economy. Then-president of the Federal Reserve, Ben Bernanke, has to find a way to stimulate the economy quickly and decisively. He undertakes a series of unorthodox policies that aim to massively increase the money supply. Trying to explain to the world these unprecedented moves he likens them to dropping money from a helicopter. Thus, he earned himself the somewhat unflattering nickname, to say nothing of the goofy cartoons – “Helicopter Ben”. It turned out the Bernanke had actually quoted our old friend Milton Freedman who first came up with the phrase “helicopter money”, but the nickname stuck all the same.

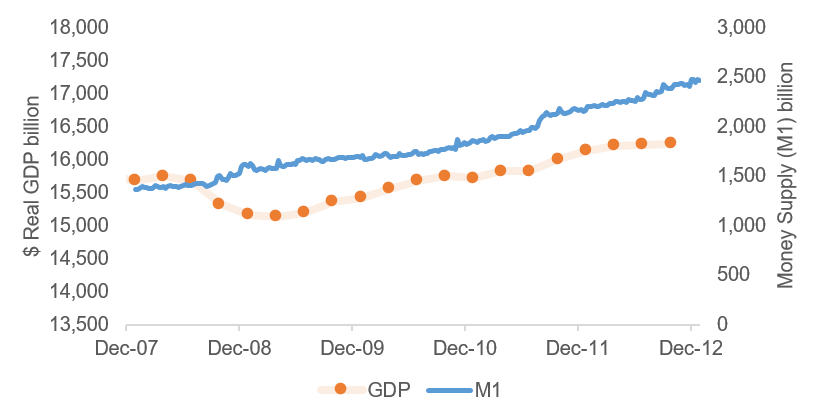

Corny economist trivia aside, starting in 2008 Bernanke, true to his promise, started pumping out cash like it was his job (which in all fairness it was). The Money Supply in the economy shot up from $1.37 trillion at beginning of 2008 to $2.46 trillion by the end of 2012, or c. 80% increase. Real GDP grew from $15.7 trillion to $16.2 trillion or c. 4% in the same period. See chart below.

So there was 80% more money, chasing only 4% more goods. Our simple economy example would imply prices should have increased by c. 76%. Meaning people’s savings should have devalued by three quarters over those four years. If there ever was a time to panic about losing your savings, 2008 was as good as it gets in a developed country. And many people did panic, throwing money into gold, fine art, and other gimmicky “inflation hedges”. To most people’s surprise though, nothing much happened.

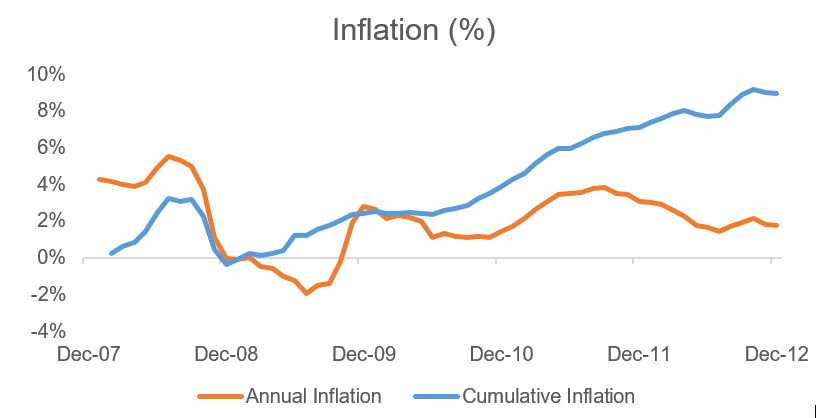

Not only did inflation not go up, it became negative and then stayed stubbornly low at below the Fed’s target of 2% annually. Throughout the four-year period, cumulative inflation was a paltry 9% compared to the c.76% expected in our simple model. It remains a mystery to this day for many financial commentators, as to why inflation never shot up with all this extra money sloshing around the economy. Did we just prove Milton Freedman wrong? Maybe they do give away Nobel prizes for no reason!

Advanced Inflation

Not so fast. Let’s stay in the box just a little longer, before we start revolutionizing monetary theory. Turns out inflation in the real world, is a tad more complicated than our simple economy but only a tad. Inflation, as Friedman formulated it, is actually driven by the following formula:

P = (M * V) / Y

Now, in the intro to the website, I said my main goal was to make this entertaining. I bet you feel lied to right now but hear me out!

All the formula says is:

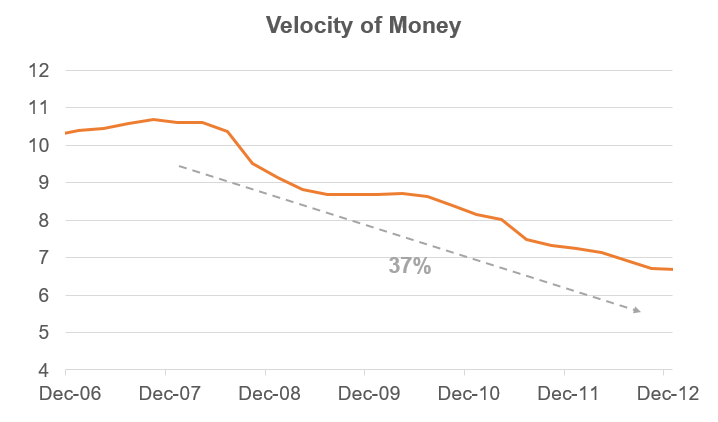

Prices = (Money Supply * Velocity of Money) / Real GDP

We already understand how prices, money and GDP (apples) are connected from our simple example. The only confusing part here is Velocity of Money. All this measures is, what do people do with their money. Do they get their paychecks and head straight to the car dealership (or shopping mall or Expedia) or do they put away their earnings, knowing they might have some tough times ahead? Unsurprisingly, as house prices were plummeting, companies were going under, and people lost jobs, the average person chose to save and the velocity of money went down dramatically as a result. See chart below.

So we now know exactly what happened to everything that is supposed to move inflation. We know that:

a) Money supply increased by 80%

b) Velocity of money cratered by c. 37%, as people tightened their belts

c) GDP initially went down but ultimately ended up about 4% higher than it started

d) Prices only increased by 9% cumulatively

So does that explain what happened to inflation:

Money supply (1+80%) * Velocity (1-37%) / Real GDP (1+4%) = 1.09 or 9% price increase – exactly how much prices moved in the real world!

There was no big mystery after all. Despite the Fed creating all that extra money, people’s reluctance to spend, meant prices did not move much. Believe it or not, this is a remarkable and still very poorly understood episode in monetary history.

However, you are well ahead of the game at this point. All you need to understand inflation is: how much money is being created in the economy, how many goods and services are being produced, and are people choosing to spend or save.

Inflation in 2021

Markets are now going through another inflation scare, and all sorts of hedge fund analysts and market commentators are talking up dubious investment strategies to avoid potential price increases (see related article (Un)stable Assets). The Fed keeps on pumping money in the economy but this time the incoming Biden cabinet is expected to supplant the Fed actions with massive fiscal stimulus. What do you think will happen with inflation? The answer is never set in stone, as policies change and people choose to act differently, but this article should give you a solid guide for interpreting economic events as they play out, and maybe even make your own forecast. I will share my own thoughts in part two of this Inflation Series.

Whatever happens, just remember: Don’t Panic!