The developed world currently does not have the inflation problems of yesteryears – monetizing government debt (see article for a primer on Traditional Inflation). The current inflation episode has a multitude of drivers, a few ineffective solutions, and one very effective – a recession. I present to you:

Inflation 2022 A Play in two Acts, produced by Joe Biden and Vladimir Putin, guest star, the Federal Reserve

Act I

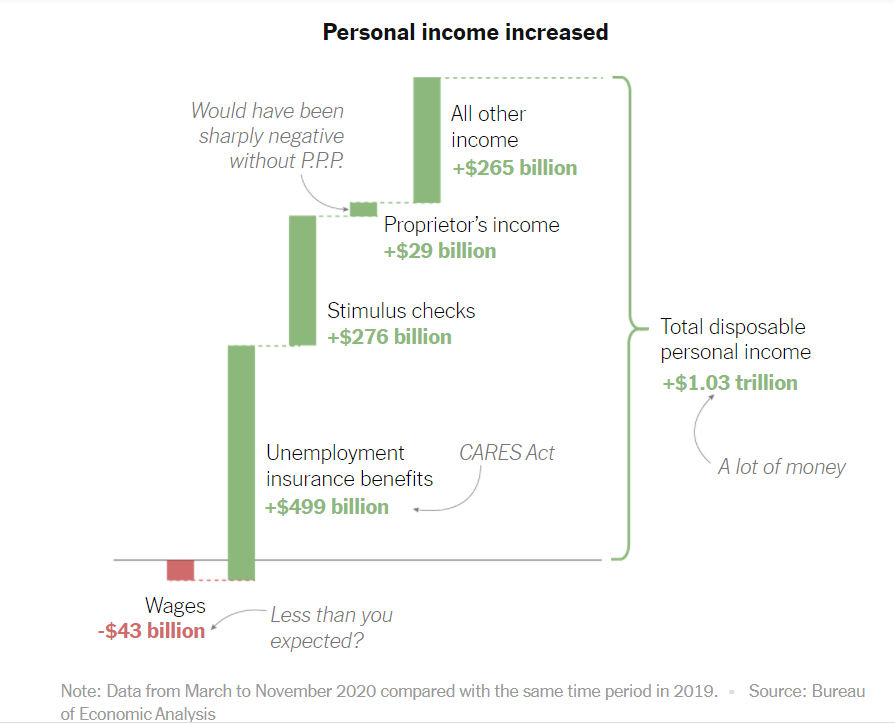

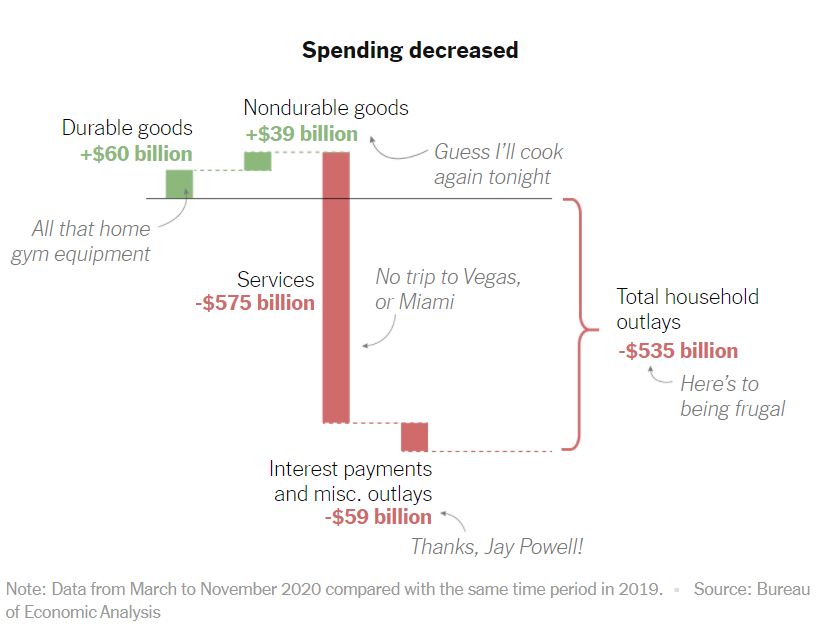

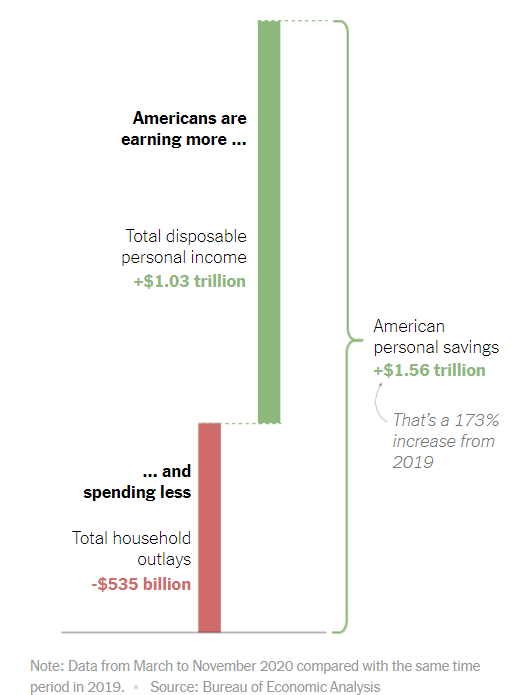

The first inflationary impulse was the Covid-related fiscal stimulus, particularly in the US. While other countries were targeting support for particularly badly hit sectors or individuals, the US Treasury sent out stimulus checks to every single adult, combined with other measures totaling over $4.6tn. That was almost six times more than the 2008 crisis relief package. It would appear that given the expected drastic drop in GDP, due to the lockdowns, the administration wanted to stimulate the economy. There were a few problems with that policy thought: 1. No one was going out spending so the extra money did not get channeled into the economy at the time but instead onto people’s savings accounts, 2. A lot of industries shut down, and continue to be disrupted to this day, so even if you wanted to spend, there wasn’t much to buy 3. Most people did not lose their jobs, and those who did received extra unemployment “top-ups” leading to a big cash build up in the economy. The tables below exemplify those points.

The government induced savings build up created the perfect environment for price appreciation once the economy reopened. People had a lot of money, and they were itching to spend it after a year indoors, which pushed up the prices of everything. It was very similar to the traditional model of inflation, where the government creates new money, and prices go up. That’s why US inflation even now (June 2022) is running higher than Europe’s. However, the saving grace for the US economy is that this was a one-time stimulus or a momentary monetary madness, if you wish. In retrospect, probably not a great idea. Still, this is not an inflationary spiral. People got a lot of unneeded cash, they went shopping after the reopening, prices went up, the government made an oopsie, end of story. In contrast to hyperinflation episodes, the US government will not (one should hope) go and do the same thing next year again. If that was the whole story, inflation would go up one year and prices would just stay at the new level without further increases.

In this whole affair the Fed, barely present, was asleep at the wheel, while it should have been on high alert after years of easy monetary policy. After the huge Covid-19 stimulus, the Fed could have mopped up all the extra cash created by the government but it didn’t probably because it was worried about unemployment or prolonging a recession if it tightened monetary conditions. Also, in the real world, you would not expect the US Treasury to create $4.6tn one day and the Fed to erase it next day. Even Washington is not that dysfunction, yet.

In short, mistakes were made, but nothing critical or perpetual. Much Ado About Nothing.

Act II

Enter Vladimir Putin, into Ukraine. Politics aside, Russia is the second largest exporter of oil in the world and the largest gas exporter. When Russia goes to war, oil and gas markets go haywire. Partly because there are supply disruptions in the present but to an ever bigger extent, because people anticipate there will be even more disruption down the road. Similar to the Great Toilet Paper Shortage of 2020, people panic and prices increase before there even is a real deficit.

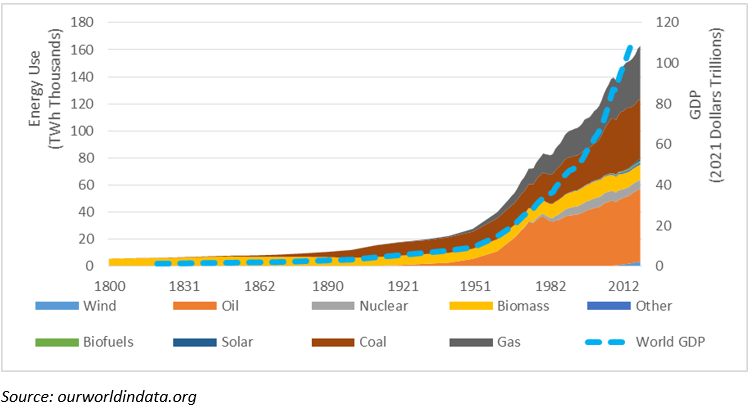

Oil and gas are also funny commodities, in that they have an outsized impact on the economy. Compare their role versus coffee, another important highly used internationally traded commodity produced by a select few countries. If Brazil invaded Colombia, the price of coffee might skyrocket. That is unfortunate for coffee drinkers but not much will change in the world. However, if the price of energy skyrockets, everything changes. The world is incredibly energy-hungry, and exponentially so. Every sector in the economy – agriculture, manufacturing, and virtually all services require vast amount of energy to produce the goods and services we consume daily. In large part the phenomenal increase in world GDP and global living standards is due to humankind harnessing more energy to power processes that were either manual or unimaginable before the industrial revolution.

(note, any half-way decent economist will tell you correlations does not mean causation. If you plot GDP versus toilet paper use, for example, you will likely get a similar-looking graph. Directionally, I think we can probably agree large scale energy production contributed more to power our economy than TP, but I might be wrong).

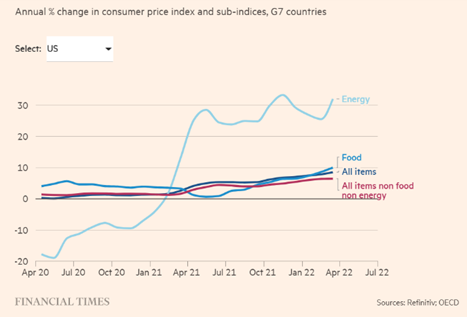

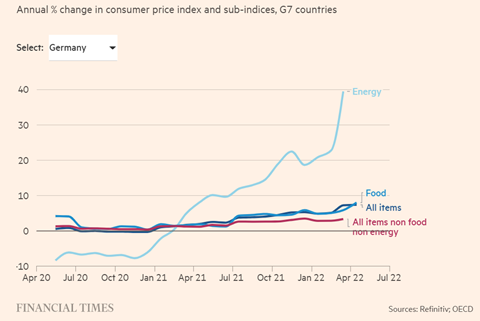

In other words, the rapid rise in energy prices, caused by the war in Ukraine, both increased the direct cost of petrol and electricity but also indirectly virtually all other products you consume, because energy is an input for most products. You can see a snapshot of inflation developments in the charts below.

The Fed’s role

A charitable description of the Fed’s role here would be “background talent”, a less charitable one would be “comic relief”. They are essentially the good natured dim-witted bumbling side-kick who always falls over himself. An Olaf (Frozen) or Timon and Pumba (Lion King, if we look at the Fed and ECB in tandem). They spent much of 2021 talking about “transitory” inflation, overlooking the effect of the US stimulus, when they should have been tightening financial conditions. Now that inflation has been spurred on by energy prices, central banks look silly doing nothing, since their only job is to contain inflation. However, there is nothing monetary policy can do about oil prices. Central banks’ only option is to slow down the entire economy so much that we don’t even need the oil any more since a number of companies will go out of business, people will lose jobs, and consumption will go down. Engineering a “mild recession” or in the language of the Fed “soft-ish landing”, as people are already facing a cost of living crisis, is a fool’s errand. And fittingly so given central bankers have turned themselves into the jesters of the court, with years of inaction and lazy monetary policy. (For people less familiar with Fed’s policy over the last 10 years, they kept pumping money into financial markets, massively distorting asset prices, and were all too happy to do so, as inflation wasn’t an issue… until it was).

In short, there isn’t much central banks can do now other than let it play out… and turn down the thermostat.

“Let it go, let it go

Can’t hold it back anymore

Let it go, let it go

Turn away and slam the door

I don’t care what they’re going to say

Let the storm rage on

The cold never bothered me anyway”

(Frozen)

Epilogue

So what is the outlook?

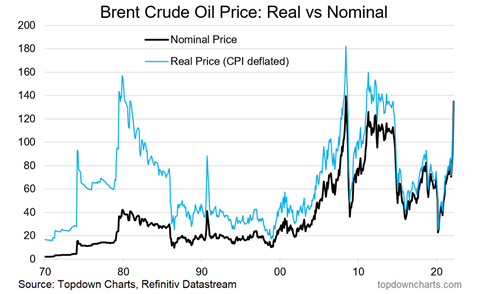

Again, this inflationary crisis, is not created by a continuous cycle of printing money but by increasing commodity prices. The extent to which inflation can run, is only bound by the prices of inputs, largely energy. What determines prices: supply and demand.

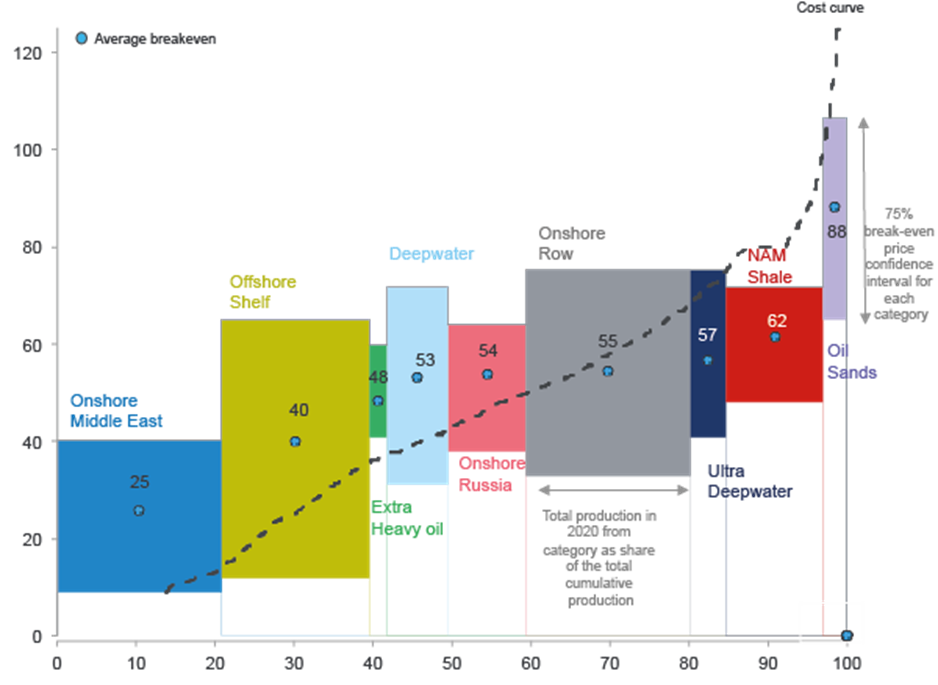

A cheeky old financial markets adage goes “the cure for high oil prices is high oil prices”. Meaning, if prices are high enough, two things will likely happen:

- (Demand) People will use less energy – you will only heat the house when you are in, you will use more public transport instead of driving, certain energy intensive businesses will cut production

- (Supply) – a number of energy producing businesses that were not profitable under low prices, will now start producing energy. Those would include shale production, deep water, oil sands, biofuels. In addition, a strong policy response in the West has given renewable energy an even larger momentum by the way of expedited permitting regimes and further subsidies.

Source: Rystad Energy

As demand falls and supply increases, energy prices will invariably come down. At that point energy will be contributing to deflation, like in 2020 (see inflation charts above). It is difficult to say exactly when this will happen but likely over the next two years, possibly even next year after the winter ‘22/’23 heating season energy crunch.

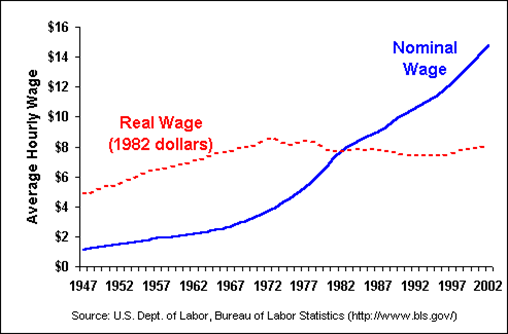

It is worth noting that even when energy prices finally come down to more “normal” levels, most non-commodity prices (electronics, haircuts, vacations) will likely stick around. That’s mostly because of your salary. People don’t like working for less money, even if inflation is going down. Once a price level feeds into the economy through higher wages, we are stuck there. You can see in the charts below oil prices are constantly oscillating, however, wages only go one way – up. Therefore, any price inflation due to energy, we are likely to undo. Any price inflation due to workers making more money (nominally), will forever stay in the price level. Good news for workers, bad news for savers – just the nature of inflation.

So if you have lost purchasing power to inflation, it will likely not come back (you could however invest intelligently to claw some of it back). However, further price rises in the West post-2023 are likely to be smaller and in line with the historical 2% target in the US and Europe.

What about the overall economic growth?

I feel quite certain, that the economy is headed for a recession, pronto. On the supply side, the crude reality is that GDP is just a measure of how much we produce. Between COVID-related supply line disruptions, more expensive energy and food, rising protectionism and “on-shoring”, on a global scale we will be producing less output. Compared to pre-2019, we are now in an environment of fewer more expensive resources that we can use less efficiently. alternatively, if you want to look at it from the demand side, money is not being printed, it is actually being destroyed, while prices are rising. We can only cope with those higher prices by consuming less.

Are there any good news?

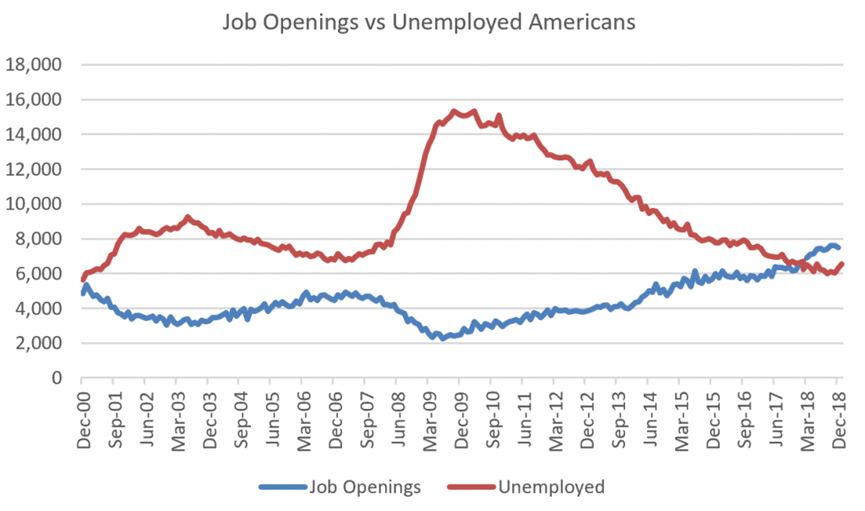

A few. For one thing, at this end of this tragedy, Europe should no longer be dependent on Russian energy, which should guarantee higher price stability and resilience to shocks in the future. We might also learn to live with less energy that is more expensive (I understand might not sound like terrific news). Still, this will be a good segue to get serious about climate change policy and finally introducing meaningful carbon prices (particularly in the US), as well as, carbon border taxes. Finally, it is still a great time to get a job or a raise, while they last. There are now more job openings than unemployed people in most major western economies, which is incredibly rare if not unprecedented, and wages are increasing rapidly.

Source: US Labour Market, St Louis Federal Reserve

When the economic cycle turns the first thing companies cut is new hiring. At the same time, the last thing they cut is existing employees (with entertainment, marketing, capex, dividends in the middle). You can still get a nice pay raise now and then stay put for the next couple of years, while the economic storm is raging. In the end, it will all be ok, but it might be a couple of lean years in the middle.

It’s the circle of life

And it moves us all

Through despair and hope

Through faith and love

‘Til we find our place

On the path unwinding

In the circle

The circle of life

(The Lion King)