If you are wondering if Bitcoin (BTC) is a good investment – the quick answer is no, it is a terrible investment. The value of a Bitcoin is virtually zero. The price of Bitcoin, on the other hand, can be as high as human imagination will take it. Ultimately, though Bitcoin will come crashing down, as fantasy can’t substitute for value forever, as every bubble in history taught us.

Summary of main points

Scarcity value

- Scarcity is not defined by the number of coins available but by the number of substitutes. Bitcoin does the same thing every other cryptocurrency does, only worse.

- There is no use case, or natural demand for bitcoin, making it worthless.

Bitcoin will be widely adopted

- More people buying Bitcoin does not mean it is more valuable

- Even if everyone buys Bitcoin and the price reaches $1 million, people can still wake up the next day and find their Bitcoin is worth nothing – much like investors in tulips, Enron, and Dot-com stocks

Gambling Mindset – “It is a small portion of my assets”, “It has larger upside than downside”, “It is for fun”

- So is a lottery ticket, but you don’t invest in lottery tickets you spend on them

- If you are looking for a life-changing event, there are other options with better payoffs

Here goes the long-form argument.

Scarcity value

Supply

Much of the investment case for Bitcoin (BTC) rests in its limited supply. There are currently 18.6m bitcoins in the market and only a total of 21m can ever be created, which will not happen until 2140, supposedly. Therefore, as GDP grows but Bitcoin supply stays relatively flat, each Bitcoin will be worth more in real terms. In theory, you should be able to purchase more goods and services with one Bitocin and thus its price should keep growing. In that regard, the cryptocurrency functions like gold, but Bitcoin is much easier to store, exchange into regular currency, or transact with.

The problem with that logic is that virtually everything in the world has limited supply – pebbles on a beach, water in the oceans, trees – but their price is still virtually zero per unit. The key on the supply side is how easily substitutable a good or an asset is.

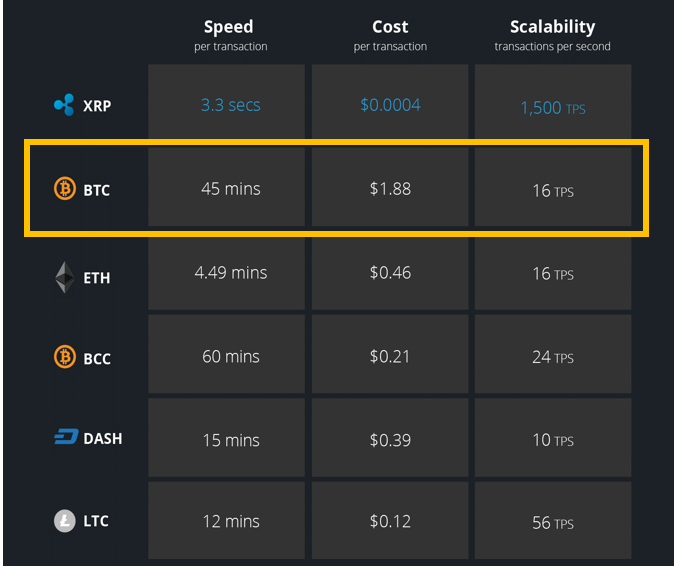

Here is an interesting fact – Bulgaria is the fastest shrinking nation in the world, projected to decline by 22% in the next 30 years. So Bulgarian labor supply is not only limited it is shrinking! Why hasn’t my salary increased by 400% (like Bitcoin over the last year) given I am a shrinking commodity? Because my labor is just as good (or arguably worse, but don’t tell my boss) as that of the Pole, Italian, Spaniard, or Englishman who offer the same services. The service Bitcoin offers is a store of value, exchange into fiat currency, and transactions. There are more than 5,000 cryptocurrencies, many with limited supply, that offer the exact same service. In fact many are better. Since Bitcoin is by now old technology, it is slow, expensive, difficult to scale and its electricity consumption is preposterous (apparently Bitcoin consumes more electricity annually than the entire country of Austria). Many people do not realize that Bitcoin is not free, transactions take longer than some conventional money transfers, and winder adoption will make the system only clunkier.

Therefore, while the specific currency Bitcoin might be of limited supply, the services it offers are actually of unlimited supply, since creating cryptocurrencies is incredibly easy. To give you another analogy, the supply of eggs from any one farm can be limited. However, since all eggs have the same value to consumers, the price of any egg in the store will be roughly the same. Just because your particular farm might only ever produce 21 million eggs, no one will pay $50,000 for one.

Demand

Not only is the supply of Bitcoin and cryptocurrencies unlimited on top of that there is very little real demand for them.

We all know that fiat money has no value on its own, it is just paper or worse bytes on the cloud. What makes the Dollar or the Euro valuable, is that there are goods and services that you can only buy with that currency. If you want a German car or a Pfizer vaccine, you need to hold Euros or Dollars, respectively. The value of the currency in real terms (before inflation) is directly tied to how many goods and services are produced in a certain economy.

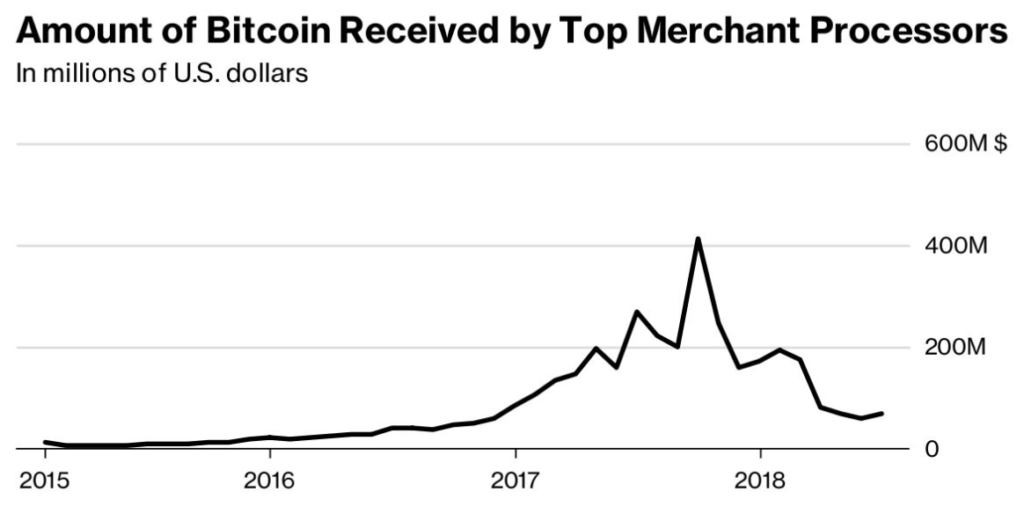

The value of Bitcoin is similarly entirely dependent on what I will call the “Bitcoin Economy”, or the goods and services bought and sold using Bitcoin. Bitcoin is mostly used in a limited number of transactions, sometimes illegal, in an effort to circumvent regular payment channels that are closely monitored by authorities. As far as payments are concerned, Bitcoin is incredibly inefficient – as it is slow, expensive, highly volatile, and most importantly not the standard currency unit of any country. Businesses have to pay taxes, employee and suppliers and prepare financial reports in their native currencies. If they choose to accept Bitcoin as payment, they will face huge costs of constantly converting back and forth to fiat currency and experiencing massive price swings in the meantime. Also, as we discussed in the supply section, there are numerous other alternatives to Bitcoin, that are more efficient and users can easily swtich. Therefore, the Bitcoin economy is destined to stay small and even shrink. In fact, that is exactly what is already happening. Bitcoin usage peaked in late 2017, as you can see in the chart below. People then quickly realized, there is very little use value of Bitcoin as a currency.

If Bitcoin functions as a real currency, the price should track closely the goods supplied in that currency, same as the Euro and the Dollar.

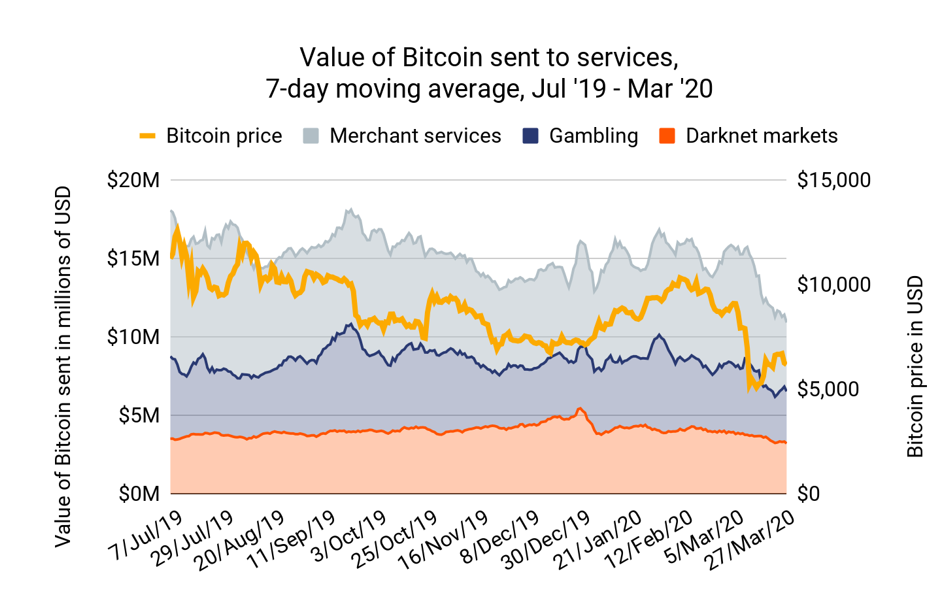

In 2019 the Bitcoin hype was largely forgotten and demand was more closely based on currency use. In that period you can see the price tracked transaction volume (the size of the economy) very closely.

In the absence of speculators bidding up the price of the currency, BTC’s value is largely determined by how many goods and services are being sold in Bitcoin and how many Bitcoins are available. As you can see in the chart above, the price seems to have been a little below $10,000 at the end of 2019. Note, I am not saying BTC is worth $10,000, I am convinced it is worth $0 in the long run, as no one will have use for it. However, what the chart tells us is that given how many Bitcoins there were in circulation and how many services were sold in Bitcoin, the clearing price at the time was c.$10k. So, if you need to buy guns or drugs online, by all means, convert some cash into Bitcoin and buy what you need. However, buying Bitcoin as a long-term investment is completely divorced from its real function and value.

In late 2020, in the mids of the Pandemic, after months of being stuck at home with little spending outlets, people started pouring money into Bitcoin. When money is channeled rapidly into anything, prices rise, whether substantiated or not. The more prices rose, the more hype there was in social and mainstream media fueling a massive bubble.

I cannot forecast how high the BTC price will go or when it will crash. People have already made (and lost) fortunes playing the Bitcoin lottery so it is not always a losing bet. All I am saying is, the intrinsic value of Bitcoin is far below the market price, much like Dotcom stocks in 2000 and houses in 2008. You can always try your luck, but you have to understand the price you would be paying now, is entirely divorced from any economic value.

Wide Adoption

Seasoned financial analysts know that some of the most dangerous words in finance are “This time is different”, which people of course told themselves in the Dotcom bubble and the housing crisis. The excuse for Bitcoin this time is that the current rally is driven by wise institutional investors with long term investment horizons and not just fringe crypto enthusiasts.

Institutional Investors

To start off, it turns out institutional investors are not piling into Bitcoin. There is an excellent article on Forbes that goes into detail on who actually is buying Bitcoin. In short, no reputable institution or pension fund has a Bitcoin investment strategy. There are excentric billionaires with wide internet presence, most notably Elon Musk, who have bought Bitcoin, which people mistook for professional investor endorsement. He then very quikcly and publicly back-tracked and Tesla stopped accepting Bitcoin. Being loud in not the same as being correct.

Evolving Market

Some Bitcoin supporters recognize Bitcoin is currently extremely volatile, a poor substitute for currency, and has little use-value. However, they claim the market will stabilize eventually and everyone will end up investing a portion of their portfolio in Bitcoin, much like in gold. In fact, a JP Morgan analyst recently published a research piece with a $146,000+ BTC price target. Mind you, that is the same JP Morgan, whose CEO Jamie Dimon said regarding employees caught trading Bitcoin – “I’d fire them in a second. For two reasons: It’s against our rules, and they’re stupid. And both are dangerous.”

But back to the point, the hefty JPM price tag, mostly hinges on the idea that Bitcoin will become widely seen as a substitute for gold and claim similar size of investors’ wallets. Gold, of course, has uses – in jewelry, medicine, technology, etc., which is why gold is valuable in the first place. Bitcoin has limited-to-no unique uses, which is why it is worthless. Therefore, no one in their right mind will allocate a portion of their investment portfolio to BTC to start with. It is a non-sequitur.

Prices are set on the margin

But let’s play out the scenario where everyone allocates a portion of their assets to Bitcoin. Allegedly, there is $250 trillion of savings in the world, according to Credit Suisse’s Global Wealth Report. If even 1% of that were channeled into Bitcoin, that would mean $2.5 trillion invested into 22 million coins or a $114,000 market-clearing price. In fact, it could be higher, depending on how much supply there is for any given trade.

However, once the dust settles and everyone has their 1% invested in Bitcoin (no matter how the high buying price was), the price action is over. The only remaining use is the Bitcoin economy, and in the Bitcoin economy, BTC prices are low. Imagine you go to a charity auction drunk one night and pay $150,000 for a “I Heart NYC” T-shirt. When you wake up the next day, the T-shirt will still be only worth about $10, which is how much a tourist would buy it for, regardless of what you paid for it.

Just because you bought Bitcoin at an outrageous price, it does not mean someone else will come along and offer the same or higher price for it. Fundamentally, for a financial instrument to have value, it either needs to have future cash flows (like stocks and bonds) or it needs to have use-value (like gold and oil). Bitcoin has neither and therefore has no place in asset allocation. Professional institutional investors know that, and widespread adoption is not on the horizon.

Gambling Mindset

Finally, possibly the most rational investment case for Bitcoin is – “I am happy to lose my money”. This encapsulates reasoning such as – “It is only a small portion of my net worth”, “It has higher upside than downside potential” or “It is just a gamble”. Now, if you have accepted you are gambling that is fine but you have to understand that is the complete opposite of investing (see article on Investing vs Gambling).

Gambling is of course just spending money on entertainment, and I am in no position to tell anyone how to spend their money (I once bought Bluetooth-enabled shoes, so I am no authority on smart purchases). However, as far as gambling goes, Bitcoin strikes me as an unlikely crowd favorite.

It is not a life-changing event

Playing the roulette you can get 36x your money back, if you guess the right number. Someone recently won the Powerball Jackpot of $731 million with a $2 ticket, or approximately 366 million times their money back. In the most recent rally, Bitcoin went from c.$10,000 to c.$40,000 or just 4x increase. If BTC reaches the JP Morgan target price of $146,000 that is still only about 4x return from current levels. In other words, gambling, as destructive and pointless as it is, at least holds the promise that it will turn your life around. It has negative expected value but on the crazy off-chance you make it, you and your whole family are set for life. With Bitcoin, you are expected to lose money, as the intrinsic value of the asset is negligible, but on the off-chance prices rally further, your upside is actually not that impressive (for gambling standards). Again, the roulette, the lottery, and Bitcoin are value destructive, so I am firmly advising against any of them. All I am saying is, if you will lose money, wouldn’t you rather go out with a bang?

There is no prize

The second difference between BTC and scratch cards is that in the lottery there IS a prize. You might not get it, but you know someone will eventually. With Bitcoin you know in the long term, it has no value. Simple logic (or sequential games in Game Theory, which is another word for simple logic) tells you that if something will be worth nothing in 10 days, it will be worth nothing on the 9th, therefore it would be worth nothing on the 8th and then all the way back to the present. Hence, the value of Bitcoin today is virtually nothing, except for the needs of the Bitcoin economy, which are negligible. There is no “prize” at the end of the yellow brick road. Of course, irrational exuberance can push the price of Bitcoin in the stratosphere in the meantime, but there is still a big nothing at the end. If I had to throw money away, I will at least want the possibility, however small, of a big check and confetti.

Conclusion

This was a long article, you get the point – don’t put your savings in Bitcoin. If you want to gamble – do as your heart desires – but don’t say I didn’t tell you it is ultimaltey a losing bet.

One thought on “The Yellow Bitcoin Road to Nowhere”

Comments are closed.